Organization of forex market ppt

Automatically changes to Flash or non-Flash embed. WordPress Embed Customize Embed. Presentation Description No description available. The Foreign exchange market presented by Name roll no Suresh bhogu 03 Edal dias 04 Misbha patel 12 Fauzia shaikh 17 CHAPTER OVERVIEW: THE SPOT MARKET 1V.

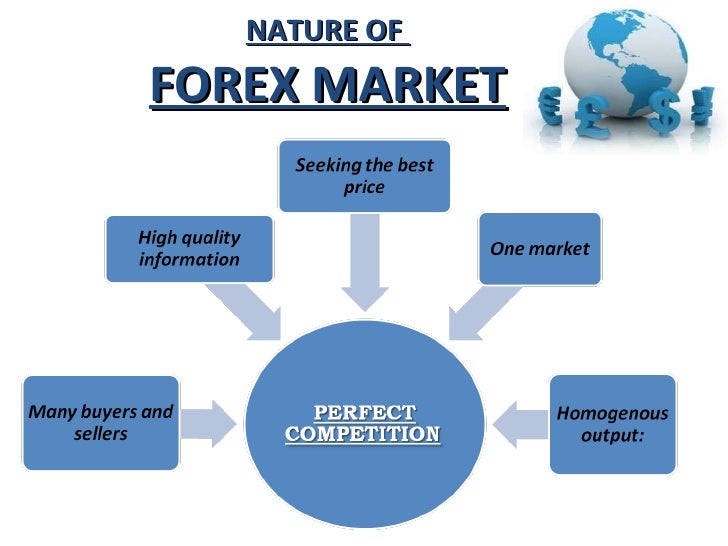

Foreign exchange market

THE FORWARD MARKET V. Where money denominated in one currency is bought and sold with money denominated in another currency. Participants at 2 Levels 1. Retail Level Business customers. Two Types of Currency Markets 1. Transactions take place at a specified future date.

Participants by Market 1. Clearing House Interbank Payments System CHIPS - Used in U. Fed Wire - Operated by the Fed. THE SPOT MARKET I.

SPOT MARKET A market for the immediate purchase and delivery of currencies. If cross rates differ from one financial center to another, and profit opportunities exist.

Role of Available Information Slide Incurring risk of adverse exchange rate moves. Increased uncertainty about future exchange rate requires 2. Demand for higher risk premium 3. Bankers widen bid-ask spread THE FORWARD MARKET: THE FORWARD MARKET I. Definition of a Forward Contract An agreement between a bank and a customer to deliver a specified amount of currency against another currency at a specified future date and at a fixed exchange rate.

Purpose of a Forward Hedging The act of reducing exchange rate risk. Covered Exposure A foreign exchange risk that has been completely eliminated with a hedging instrument. Forward contract for foreign exchange Derivative instruments Slide Forward Rate Quotations 1.

Quoted to commercial customers. Quoted in the interbank market as a discount or premium. Forward Contract Maturities 1.

FOREIGN EXCHANGE MARKET |authorSTREAM

Longer-term Contracts Slide Covered Interest Arbitrage 1. Interest rate differential does not equal the forward premium or discount.

The Forex Market: Who Trades Currency And Why? How can I Compete with the Big Banks?Funds will move to a country with a more attractive rate. As one currency is more demanded spot and sold forward. Inflow of fund depresses interest rates.

And minor mistake can create a biggest problems. Enter one or more tags separated by comma or enter. Numeric tags are not allowed.

Open Monday to Friday, 8 AM to 6 PM EST. Sign Up Sign In Take a Tour Help. PowerPoint Templates PowerPoint Diagrams. Upload from Desktop Single File Upload. Presentations PPT, KEY, PDF. Presentations PPT, KEY, PDF PowerPoint Templates. FOREIGN EXCHANGE MARKET fussy. The presentation is successfully added In Your Favorites.

The Foreign exchange market presented by Name roll no Suresh bhogu 03 Edal dias 04 Misbha patel 12 Fauzia shaikh INTEREST RATE PARTY THEORY.

International Trade and Capital Transactions Location. Role of Available Information. Bankers widen bid-ask spread. Forward contract for foreign exchange Derivative instruments.

Christmas Markets across Europe - vu By: Foreign Exchange Market By: FOREIGN EXCHANGE MARKET By: Important Things to Know About Trading On the Foreign Exchange Market By: Tips For Investing In The Foreign Exchange Currency Markets By: Speculation IN FOREIGN EXCHANGE MARKET By: Channel Statistics Included in these Channels: You do not have the permission to view this presentation.

In order to view it, please contact the author of the presentation. Account Join Now Sign In Premium My Presentations Education Specials. RSS Featured Featured Audio Featured Animated Latest Uploads Most Liked Most Viewed Featured Lessons.

Go to Application Have a question? Call us at US Open Monday to Friday, 8 AM to 6 PM EST. HTTPS Hypertext Transfer Protocol Secure is a protocol used by Web servers to transfer and display Web content securely. To prevent users from facing this, Use HTTPS option.