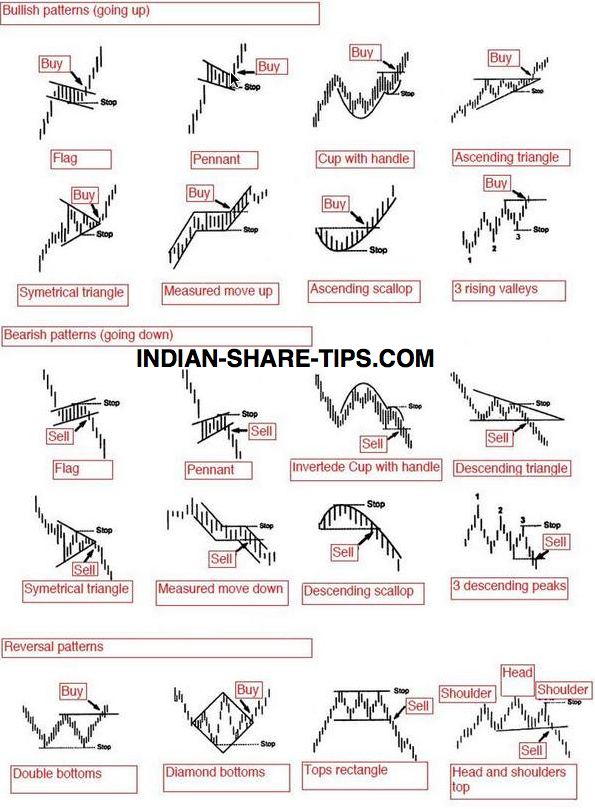

Indian stock market bullish or bearish

Last month the index fell over points one day. In general, the equity market in India is volatile just like other emerging and frontier markets.

The Indian market has experienced strong bull and markets over the years since Is the market caught in an 8-year bear cycle? Your email address will not be published.

Subscribe in a reader. Home Foreign ADRs List Downloads Indices ETF Lists About Us Education Stock Lists Dividend History — US Stocks.

Duration of Bull and Bear Markets in Indian Stock Market Posted by David on 21 March , 3: The following chart shows the bull and bear market durations of the Sensex: Click to enlarge Source: The bear market at that time lasted just 13 months. Bull markets are also characterized by swift and violent moves in a short time.

Duration of Bull and Bear Markets in Indian Stock Market | utabumo.web.fc2.com

While there are an infinite number of reasons that can be attributed to the movement of any market including the Indian equity market, here are a few reasons why Indian equity market is volatile: The debt market bond market is undeveloped and is very tiny.

As a result much of the capital flows into equities driving volatility.

Bearish divergence How to Trade in Hindi - Technical Analysis for Indian StocksForeign institutional investors are some of the major players in the market. Operating from tax heavens such as the Mauritius such investors plough billions of dollars into the market pull them swiftly out at signs of any trouble.

Retail investor participation in India is still very low. By one estimate it is just 3. As a result, major investors such as institutions, mutual funds, wealthy individuals control the direction of the market. Ordinary retail investors are some of the most impatient investors anywhere including India.

Home | Stock Commodity FOREX Market Today - Investment Strategies & Market Timing Service

So when the markets go up they pile up pushing prices higher and higher and run for the hills when markets fall. Though there is a lot of hype and hope among investors about India being the best of the BRICs now, plenty of fundamental structural issues remain in the Indian economy. Indian companies, including large-caps, traditionally have low dividend yields.

Due to the low payouts, investors buy stocks hoping for price appreciation rather than yields. Leave a Reply Cancel reply Your email address will not be published.

Enter your email address: For Informational Purposes Only. Information posted on this site do not constitute investment advice in any way to buy or sell a security. Do your own due diligence before making any investment decisions.