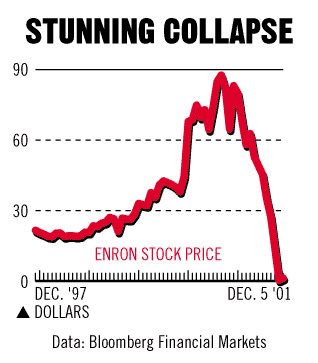

Enron stock market prices

On July 21, the telecommunications giant WorldCom filed the largest bankruptcy petition in U. Both bankruptcies resulted from corporate mismanagement, accounting malpractice, and symbolize the broader crisis in corporate governance—a crisis which involves top blue chip companies, has reached political leaders at the highest levels of government, and has resulted in high levels of volatility in U.

The collapse of Enron was a shock when it was announced early in , both because of the size of the enterprise and, more importantly, because its underlying cause was corrupt corporate manage-ment.

Yet at the time it seemed an isolated, if unfortunate and costly event. Since then, a surprising number of blue-chip companies, including WorldCom, Xerox, and Bristol Myers-Squibb, which for years were part and parcel of all that symbolized the seemingly endless expansion of the U. While Enron in isolation had a limited effect on the stock market, the combined effect of the subsequent scandals has driven the market into a downward tailspin, which seems impervious to the recent speeches by President Bush and Federal Reserve Chairman Greenspan and the unanimous Senate passage of accounting and corporate governance reform legislation.

After falling steadily and sharply the preceding weeks, the Dow Jones Industrial Average DJIA plunged points on July 15 and then recovered to close down 45 points, or 0. Part of the problem stems from the public perception that the scandal is situated at the center rather than the periphery of the system.

It hinges on companies misreporting their earnings, thereby skewing the price-earnings ratio, a measure which is at the core of most decisions investors make about where and when to invest.

It has also reached actors at the highest levels of the political system.

Not surprisingly, all of this has taken its toll on markets at home and abroad, and at the same time has reduced the relative advantages for investors worldwide of holding stock in U. While much of the public debate on corporate governance has focused on the inadequacy of accounting rules and their enforcement, there so far has been little study of the economic costs of the scandals.

Historic Stock Market Crashes, Bubbles & Financial Crises |

This is particularly important at a juncture in U. Almost 50 percent of U. While only 5 percent of retirement funds were placed in mutual funds in , 21 percent of them were so invested in Mutual fund shares of k assets, meanwhile, were 44 percent of the total in , compared to just 9 percent in Implications for Structural Reform of the Financial Sector Martin Neil Baily and Douglas J.

Thompson Tuesday, July 13, Systematically measuring the economic costs of the crisis would require a complex analysis of the interaction of the effects of the stock market drops with a host of macroeconomic variables, as well as with actual and difficult-to-predict anticipated fiscal and monetary measures.

While we are exploring an alternative analysis based on the differences between European, Japanese, and U. The Standard and Poor index, closing at on July 19, has lost a bit more: Guatemala By World Trade Organization Trade Policy Review Sri Lanka By World Trade Organization Declines in stock value can adversely affect the economy in at least two ways. As consumers feel poorer, they are likely to spend less. Other things being equal, a lower stock market—especially one that is associated with more volatility—should drive up the cost of equity capital, and thus diminish investment.

Similarly, investment can be dampened to the extent that firms expect lower consumption and more uncertainty, both of which can and are likely to be associated with a drop in stock prices. Translating changes in stock market wealth to effects on consumer expenditures is the subject of much debate among economists.

Recognizing this uncertainty, we nonetheless adopt the Federal Reserve Board estimate, which suggests that over a period of twelve months, an extra dollar of stock market wealth increases spending an average of three and a half cents. Alternatively, each dollar decline reduces spending by 0. This model assumes that the effects of the drop in stock market wealth are linear. In other words, regardless of the extent of the drop, the per dollar effect is the same. If the market drops a great deal further, the negative effects could be greater than we assume, as most holders of stock market wealth have a greater margin for reducing consumption than the average consumer, and might cut their spending even further.

The Fed model assumes that investment would fall 0. While this assumption does not account for adjustment costs and other feedback effects on investment, the overall model that calculates the combined effects of all the variables on GDP does. These estimates do not take into account possible longer term supply-side disturbances—those that affect prices or production—related to the collapse of several large companies.

Of course, should the market turn around—and eventually it should and will—these adverse effects will be reversed. But for now, the estimates suggest that the cumulative impact of the scandals on GDP is significant. Authors Carol Graham Leo Pasvolsky Senior Fellow - Global Economy and Development , Brookings Global — CERES Economic and Social Policy in Latin America Initiative Twitter cgbrookings R Robert E.

Litan Nonresident Senior Fellow - Economic Studies S Sandip Sukhtankar. What would have happened to stocks had the accounting scandals not occurred?

Although making market projections is a hazardous exercise under the best circumstances, it is useful to look at credible, pre-scandal projections as a way of checking the estimates based only on the actual stock price drop over the past three months. In fact, credible predictions of stock market trends made in January , pre-Enron, and June , pre-WorldCom, were already anticipating a sluggish market, but not the impact of the accounting scandal.

When the poll was taken, one would have expected these analysts to factor in the effects of September 11, the economic recovery, and the Enron bankruptcy case into their forecasts, while not knowing about the full extent of the accounting scandal, as the Arthur Andersen shredding news had not broken. The July 19 close of was points, or 30 percent, lower than the mean prediction.

It is impossible to predict how much further the market will fall, and how long it will stay down. Our projections are made during a time of high market volatility, and so we propose two estimates of the costs of the scandal: In this case, our estimate for the change in GDP using our base case assumption is -.

In addition to what the Fed model has already assumed about the effects of the stock market decline on investment, there may be investment-related trends whose origin is independent of the corporate scandals but still affect the economy. Given earlier over-investment, firms today are controlling costs.

Goldman forecasts a 6 percent drop in business investment this year and a modest 5 percent increase next year. The paradox is that if enough firms cut costs, it can become pervasive enough to undermine the predicted economic expansion. Confidence in predictions of future consumer demand play a role in determining how much companies are willing to invest, and the uncertain environment created by the declining market and the crisis in corporate governance could serve as a negative feedback loop in the process.

Moreover, the corporate governance crisis almost certainly has discouraged foreign investment into the United States, which has manifested itself in, among other things, a decline in the value of the dollar. For example, between March 19 and July 19, the trade-weighted value of the dollar fell by 5. The drop in the dollar is not unwelcome, however. Although a lower dollar pushes up the price of imports and domestically produced goods that compete with imports, the underlying rate of inflation has been low, so any crisis-induced inflationary impact is unlikely to induce the Fed to raise interest rates any time soon on the other hand, the demand-depressing impact of the crisis may cause the Fed to lower interest rates.

Furthermore, a lower dollar will encourage foreigners to buy more U. Our assumptions about the costs of the scandal suggest that the economic price will be fairly large and may last for a prolonged period of time.

An important question is how long will it take to restore confidence and reverse the downward trend. This is difficult to answer given that we do not yet know the full extent of the scandals. Yet we can use historical evidence to estimate how long it takes for the market to recover from major downturns.

Nonetheless, the current market downturn has unique worrisome characteristics of its own: Indeed, the market failed to turn up after two major economic addresses by President Bush, the unanimous Senate approval of the reform legislation to overhaul the regulation of corporate governance, and, most importantly, an upbeat speech on the economy by Federal Reserve Board Chairman Alan Greenspan. Generally, the market turns up prior to economic recoveries, serving as a leading indicator.

In this case, the recovery that seems to be underway could be slowed by the exogenous effects of the scandal on the market. In short, investors want more than words. They want earnings figures they can trust and evidence that those figures are rising. Continued economic recovery should produce rising earnings, but restoring confidence in the reported numbers—whatever their true underlying values—is another matter. A final effect of the current crisis in confidence, which is harder to measure and has so far received virtually no public attention, is that on the commitment to market-based economic institutions and reforms elsewhere around the world.

Numerous developing countries around the globe, and most notably in the Western hemisphere, have turned to the market in recent years. The United States, in particular, has for the most part served as a model of an efficient and effective market economy. Yet in recent months, the turn to the market has also met increasing public frustration in these countries, due to mixed results in some of them and to sharp economic downturns exacerbated by fluctuations in international financial markets—with Argentina being the most extreme case.

There is a more general public questioning of the market, of free trade, and of the wide scale privatization of pension funds that many countries have undertaken. More worrisome, these trends are coupled with the recent reality of Argentina defaulting on its sovereign debt and with warnings of a possible default by Brazil, a default that in the end could be driven by lack of confidence in emerging market equities.

Deeper downturns in the developing economies will, in the longer run, contribute to the costs to the U. Assuming the market stays down for a prolonged period of time, the crisis in corporate governance is likely to have sizable costs for the economy. The estimates we present here will be greater if the market drops well below its July 19 levels or lesser if the market rises above these levels. Our estimates of the costs of the scandals are much more conservative than what these new figures may suggest.

While wealthy corporate executives incurred the costs, consumers will pay the price. The price—in both real dollars and consumer confidence—already has given policymakers impetus to enact new reforms in accounting and corporate governance.

The question now is how soon investors will again have enough confidence in the corporate information system to come back to stocks and thus ensure that the cost so far suffered will be short-lived.

The Brookings Institution The Brookings Institution.

Facebook Twitter LinkedIn Email Print SMS More Reddit Google Stumbleupon. Brookings Policy Brief Series. Report Cooking the Books: The Cost to the Economy Carol Graham , Robert E. Litan , and Sandip Sukhtankar Thursday, August 1, Download Download PDF File Download. POLICY BRIEF The collapse of Enron was a shock when it was announced early in , both because of the size of the enterprise and, more importantly, because its underlying cause was corrupt corporate manage-ment.

Data-Driven Innovation By Organization for Economic Cooperation and Development OECD.

The Rise and Fall of Enron

Guatemala By World Trade Organization. Trade Policy Review Sri Lanka By World Trade Organization. Carol Graham Leo Pasvolsky Senior Fellow - Global Economy and Development , Brookings Global — CERES Economic and Social Policy in Latin America Initiative Twitter cgbrookings.

Litan Nonresident Senior Fellow - Economic Studies. TechTank Keeping the internet open for the future Tom Wheeler. Regulatory Policy Power to the people: A new trend in regulation Robert Hahn , Robert Metcalfe , and Florian Rundhammer. About Us Research Programs Find an Expert For Media Careers Contact Terms and Conditions Brookings Privacy Policy Copyright The Brookings Institution.

Send to Email Address Your Name Your Email Address jQuery document. Sorry, your blog cannot share posts by email.