Where to put stop loss in forex trading

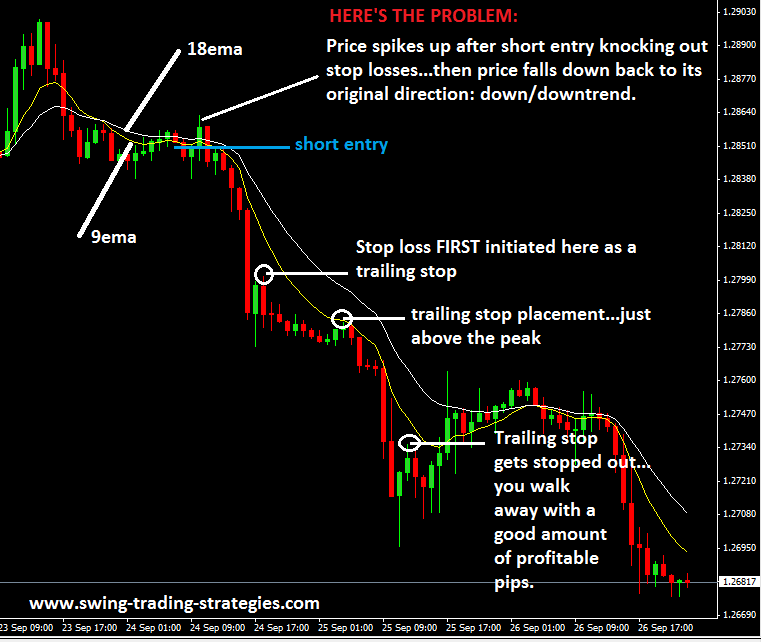

While we form expectations and make trading decisions based on what we believe will happen using our tested method, the fact is at any moment price can do anything. Stop losses control risk, but need to be placed at a price that still allows the market to move toward the target.

Once set, a stop loss can also be managed as the trade progresses.

While this is a drawback, I have found that typically I would have taken an even larger loss had my stop loss not been there. Overall, slippage has never been an issue for me and I have been trading since It is important to place a stop loss so you have a good idea how much a trade could lose. While no one wants to take a trade thinking they will lose, losses are a constant in trading , and losses must be kept in check in order to succeed.

Setting a stop loss also allows you to determine your position size. Even following these guidelines it is possible to make a substantial amount of money see: How Much Money Can I Make as a Day Trader. Therefore, the ideal position for your stop and risk management protocol is shares.

This example greatly simplifies things though. A stop loss should not be placed at an arbitrary level. It should be at price level, that if hit, will show you were wrong about the trade at least for now.

I use one method for setting a stop loss, and it can be applied to almost every strategy I trade. Have a stop loss method you can use no matter what market you are trading, or not matter what time frame, it greatly simplifies things. My preferred stop loss method is a fixed stop loss.

It may vary slightly based on what market I am trading or what time frame, but overall, every single day and every single trade I know that my stop loss is going to be pretty close to this fixed amount.

My stop loss is placed 5 pips outside the opposite side of the consolidation from the entry. The chart below shows an example of this. The AUDUSD formed a choppy consolidation right along a descending trendline. This signaled that I wanted to go short when the price started to drop again.

The same method is applied when day trading forex, except my stop loss will go 1 pip plus the spread when applicable outside the consolidation. This makes it easy to place stop loss orders quickly, and not have to second-guess where you should be putting it on every trade.

Learn Forex: How to Set Stops

This stop loss method is designed for the strategies I trade. Effective means it gets you out of trades that would have resulted in even bigger losses, but still allows you to profit on more than half of your trades.

Check out FXOpen—offering the absolute lowest spreads on ECN accounts: When I day trade ES futures I use a similar approach.

How to Use Stop Loss in Forex Trading - Wetalktrade

Every day, every trade, my stop loss is the same. This allows for me to rapidly place orders. My initial target goes 8 ticks away from my entry point. Entry, Stop Loss red and Target green on Futures Chart click to enlarge. That said, some basic stop loss management—such as reducing risk once a trade is closing in on the profit target—is acceptable.

Risk should never be expanded; move stop loss orders to reduce risk, but never to increase risk. With day trading and swing trading you need to control risk. Use a stop loss! A stop loss is required in order to determine your position size. When I am wrong, I am wrong small. As you improve, and you have the discipline to let the price hit your stop loss or target, then consider managing your stop loss while in a trade to potentially improve performance.

Trading is one way for people with desire, discipline and the willingness to put in some time can earn an income from anywhere in the world. It leads you step by step through a process for becoming a successful traders, as well as providing strategies and trading plans you can use to build your capital in a risk controlled manner.

Forex Money Management

By Cory Mitchell, CMT. Basically zero spread on ECN accounts and low commissions , low spreads on normal micro and standard accounts, easy withdrawals and deposits, prompt customer support, regulated not available to US residents. Can help assess probabilities of trades and therefore help to filter or confirm upcoming trade signals. Where to Set a Stop Loss When Trading Posted on January 18, by Cory Mitchell, CMT. Where to a Set Stop Loss When Trading I use one method for setting a stop loss, and it can be applied to almost every strategy I trade.

AUDUSD hourly chart click to enlarge. Leave a Reply Cancel reply document.

Where Is the Best Place for Stop Loss and Limit Orders?

Sign Up for Our Free Trading Newsletter. How to Day Trade Stocks In Two Hours or Less Extensive Guide How Much Money Do I Need to Trade Forex?

Why Most Traders Lose Money and Why the Market Requires It Day Trading Stock Picks for Week of June Trading Courses Trading Tutorials Free Trading eBooks Canadian Investor Forex Stats About Us.