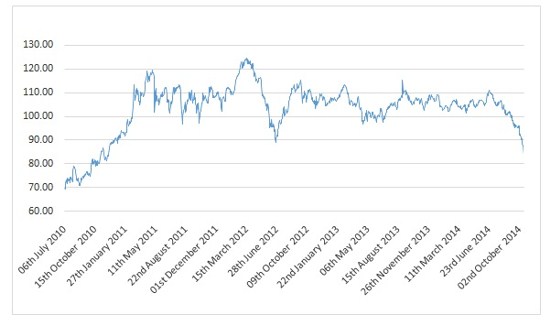

London stock exchange prices in pennies

If you are new to the world of the Stock Market, one of the first things you have to learn is how to read a stocks price. This might seem really simple and rudimentary right? For example what is the bid price? What is the difference between the bid and the ask? All these questions and more will be answered in the following article. Watch the video, or read the article below.

If a stock is currently trading, e. This is the price at which the stock last changed hands from seller to buyer. One important thing to note is this example is from the LSE the London Stock Exchange and stock prices here are quoted in Pence. There are of course Pence in a Pound. This is the time at which the last share was traded.

Here you see 5: This is the difference between the last closing price and the current price Last Price. Here we see that British Airways has increased 2. Now it gets interesting. The open price is the price at which the first share was traded for the current trading day. Here we see that the share price opened at This means the stock price gapped up on open by 0.

The Bid Price can be tricky to remember. The Bid Price is the current market price offered for the stock. The BID is the price you would get when you want to get RID of the stock. The Ask or Asking Price is the opposite side of the trade to the Bid Price. If you want to buy a stock this is the price that someone else is ASKING for it.

The Ask is the current price that it will cost you to buy each stock. But why is there a difference? If one person is selling the stock at BID This is called the spread. In the case of British Airways on the London Stock Exchange lots of shares are traded every day.

So the people handling the transaction between the buyers and the sellers have no problem finding matching partners for the transaction. When a stock is traded a lot, it means it is very Liquid , or has a lot of Liquidity. When a stock is very rarely traded and the buyers and sellers cannot agree on a price to make a trade, then the spreads tend to be larger.

Where does this difference in the BID and ASK Price go.

Stocks with a large spread can be a problem. It tells you 2 important things: The 52 week range is the value between which the stock price has moved within the last 52 weeks. Here we can see that the stock price for the last year has fluctuated between Finally we see the volume.

This is how many shares have changed hands during the current trading day.

Stocks and prices - London Stock Exchange

Here we see nearly 2. If you wish to enroll for a Free Stock Market Training Course including free E-books and Videos, see the Trading Academy Free. If you wish to take a look at a Premium Stock Market Training Course — check out the Liberated Stock Trader PRO Do you want the knowledge to invest with confidence? Buy the Liberated Stock Trader PRO Training Package and receive 16 hours of video lessons and the Liberated Stock Trader Book - fast forward your future.

TECHNICAL ANALYSIS — Chart Reading is not Voodoo, it is science. YOU will gain an incredible understanding of expert charting techniques, covering the most important methods, indicators and tactics, to enable you to time your trades to perfection.

STOCK MARKET STRATEGY — Develop your own stock market strategy and learn how to create your own winning stock system. This incredible package includes: Hi de murph, stop loss orders are usually filled when the stock price moves through the value you have specified.

Rules and regulations - London Stock Exchange

Thank you for sharing the information. Why the open price is difference from previous close price? In what condition this will happen? This affects price out of the normal market hours.

Then when the market opens, it opens near the out of hours last traded prices. Hi Barry, thats absolutely great, it is much appreciated.

I must say, a lot of my doubts are clarified now. When you are starting out in the stock market, it is best to invest in what you know. The more familiar you are with a particular business or market niche, the better you will be at knowing whether a certain investment is likely to pay off.

As you learn more, you can expand your investments.

Excellent goods from you, man. I have have in mind your stuff previous to and you are simply extremely excellent. You make it entertaining and you continue to take care of to keep it wise. I can not wait to read much more from you. This is really a great website. Login or Register About Contact. Home 3rd Grade - Fundamentals Made Easy What is a Stock Price — Bid — Ask — Spread — Do you want the knowledge to invest with confidence?

TAGS ask bid close liquidity open spread stock price. Previous article The Far Right Revolution against Global Capitalism.

Next article Top 10 Stock Market Tips.

Stock Options — Top 10 Tips for Stock Options Success. Top 10 Stock Market Tips. Top 10 Stock Tips — Video Lesson. Hi Mitzi, the reason for the price difference between open and close, is that people trade in after hours markets.

Barry, any ides, how many shares a company can publish as a public issue…? Very very thankful to u for this gr8 explaination….

How to Win as a Stock Market Speculator - Alexander Davidson - Google Livres

LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! Independent, Unbiased Education This is an independent, unbiased resource for learning to trade the stock market.

Liberated Stock Trader receives no payments from any company whose stocks are discussed and promotes no particular stock. If the author holds a stock it will be disclosed in the article. Privacy Policy We will never share your details with any third party. Disclaimer This site is provided to you for informational purposes only and should not be construed as an offer to buy or sell a particular security or a solicitation of offers to buy or sell a particular security.

A Simple Introduction to Fundamentals. Company Accounts — The Income Statement.