Wave broker elliot forex

Bank of Japan left the monetary policy parameters unchanged while inflation expectations remain weak despite improving economic conditions. As a result, JPY is the weakest currency from the G10 basket and is the only one losing to the dollar.

The US dollar is gaining ground across the board again.

Elliott Wave Forex Trading Strategies

On Friday 16th of June, the event calendar is busy with important economic news. Eurozone will unveil the Consumer Price Index, Russia will present Key Bank Rate decision, and Canada will post Foreign Securities Purchases.

The US will publish Building Permits, Housing Starts, and Michigan Consumer Sentiment Index. At the beginning of the week, the US Dollar is weak, it only gains against NZD. Precious metals and grain are getting cheaper, crude oil is gaining slightly. On the Asian stock markets, weak sentiment is dominating after the direction set by Friday's depreciation of the of the US technology market blue chips. On Monday 12th of June, the event calendar is not busy at all and just few important data are scheduled for release.

Market participants are preparing for the main event of the week, which is Federal Reserve's interest rate decision and statement on Wednesday, 14th of June. Chinese and Japanese data disappointed overnight. The disappointment with the macroeconomic data has contributed to the temporary weakness of the Japanese yen, which is currently the leader in the G10 0. The weakness of the US dollar is not used by its counterparts from Australia 0.

The Pound Sterling 0. On Thursday 8th of June, the event calendar is busy with important macroeconomic data, but there are only two events that really matter today: ECB interest rate decision and press conference and the parliamentary elections in the United Kingdom. Crude Oil is trading 0. On Tuesday 6th of June, the economic calendar is very light in economic data. Nevertheless, global investors will pay attention to Sentix Investor Confidence and Retail Sales from the euro area, JOLTs Job Openings data from the US, and Ivey Purchasing Managers Index data from Canada.

The broad market index of the SP recor01ded another marginal peak at points, so saying "Sell in May and go away" somehow does not bring the expected results so far.

Read more at http: Today's volatility is limited and, given today's holiday in many important financial centers, it is difficult to count on a change of this situation.

The strong finish of the week on Wall Street does not improve the mood in Asia. Shanghai Composite and Hang Seng are under the line.

Of the major indexes, only gains are rising by modest 0. On Monday 5th of June , the event calendar is light in economic releases, but the global investors will pay attention to set of the PMI releases from across the Eurozone, PMI Services data from the UK and Revised Nonfarm Productivity data from the US.

Strong data from ADP and ISM are supporting the US Dollar, but the market is in the waiting mode ahead of the key event of the week, Non-Farm Payrolls report.

Gold weakens under strong Dollar pressure and WTI crude oil is unable to hold higher.

On Friday 2nd of June, the event calendar is busy with important news releases, so global investors will pay attention to PMI Construction data from the UK, Producer Price Index from the Eurozone, Trade Balance from Canada and Unemployment Rate and Non-Farm Payrolls data from the US.

After the poor data from China, AUD was heavily sold. The Shanghai Stock Exchange moved down, but the rest of the indexes are trading flat. Crude Oil rebounded after better-than-expected stockpiles data. On Thursday 1st of June, the event calendar is quite busy with important news releases, so global investors will pay attention to PMI Manufacturing data from the Eurozone and the UK, ADP Non-Farm Employment Change, Unemployment Claims, and ISM Manufacturing PMI from the US.

Not much changes across the financial markets overnight. The Asian session was noted with low volatility, Shanghai Composite is up 0. On FX market only the British Pound is losing ground as the YouGov poll for The Times pointed out that Tories could run out of 16 seats to reach a majority in parliament.

On Wednesday 31st of May, the event calendar is quite busy with important economic releases, so global investors will pay attention to PMI Manufacturing data from China, German Unemployment Rate, and Retail Sales data, Net Lendings to Individuals and Mortgage Approvals from the UK, CPI and Unemployment Rate in the Eurozone, Gross Domestic Product from Canada and Pending Home Sales from the US.

Forbidden

The Euro lost ground overnight amid mounting political risks. The Chinese market is still closed for the holiday, but general sentiment in Asia is cautious with a slight risk aversion.

How to Trade Forex Using Elliott Waves - utabumo.web.fc2.com

The commodity market continues to move sideways due to the closure of major stock exchanges. On Tuesday 30th of May, the event calendar is quite busy with important economic releases, so global investors will pay attention to French GDP data, German Preliminary CPI data, Canadian Current Account data, CB Consumer Confidence, and Financial Stability Review presented by Reserve Bank of New Zealand.

Not much volatility on financial markets during the night takes place, but the US Dollar is losing ground slightly as the FOMC minutes have shown increased Fed cautiousness over the pace of monetary tightening. Sentiment in the stock market is positive despite the recent terrorist attack in the UK.

Crude oil remains high before the OPEC meeting.

On Thursday 25th of May, the event calendar is quite busy in important data release, so market participants will pay attention to Second GDP Estimate and Business Investment from the UK, Unemployment and Continuing Claims from the US, and the National CPI Index data from Japan later in the night.

Do zobaczenia na TradingView! Moja strona z analizami to: Tuesday night in the markets was definitely calm. The Australian dollar is again one of the worst performers. The Asian session was calm after yesterday's strong changes. Shanghai Composite is, however, at the slightest minus. On Tuesday 9th of May, the event calendar is light in fundamental data, but global investors will pay attention to Building Permits data from Canada and JOLTs Job Openings data from the US.

There are two speeches from the FOMC members scheduled later in the day as well. EURUSD USDCAD OIL https: Copyright Elliott Wave Forex, Futures and Stock Market Blog Designed by Free Wordpress Themes Bloggerized by Lasantha - Premiumbloggertemplates.

Home Courses Szkolenia What is XM about? Trade Audit Trail Social Trading Partners BD Global Instaforex HotForex ArgusFx XM Markets About Sebastian Seliga Global BD Trading BD Global Elliott Wave Brokers Contact. About Me Sebastian Seliga. DAX30 Daily Analysis After Brexit.

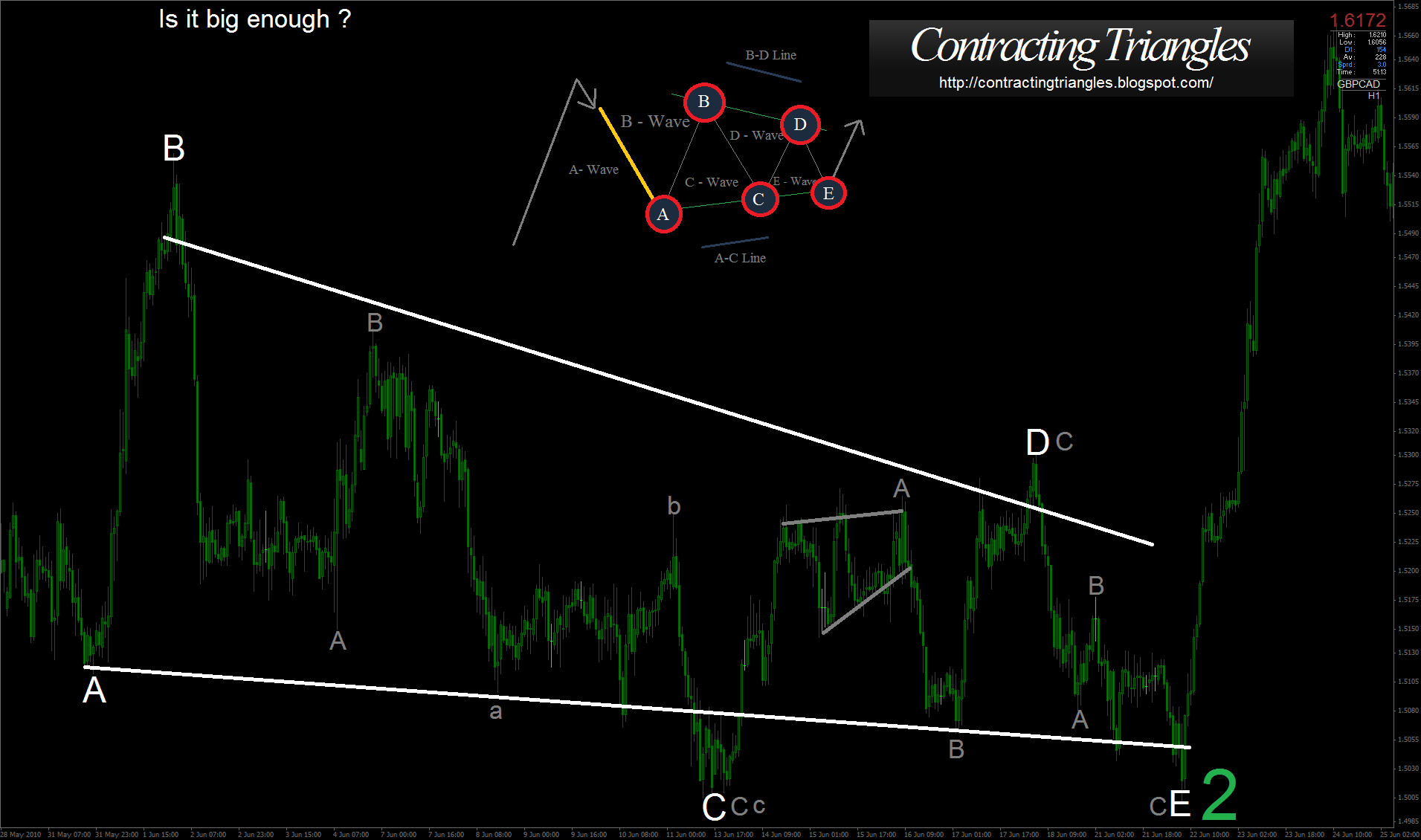

The corrective structure of wave C is getting now clearer as it was before. The market is mov It looks like one the market needs only a slight push towards the level of 1.

Crude Oil H4 Analysis. General overview for The sideway price action in corrective cycle continues to chop. Two important zones, marked as The corrective cycle in wave 2 is getting more complex and time-consuming. The market had sl Weekly, Daily and H4.

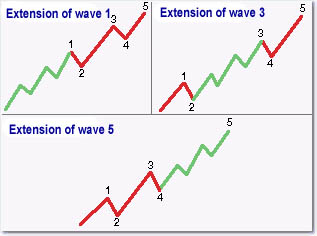

Elliott Wave: Solving The Probability Problem

The situation in the long-term perspective is not quite clear at the moment as there are two po Two possible scenario are available here to consider: The top of the wave 3 seems to be in place and now a large, corrective cycle in form of a triangle patt The current corrective cycle labeled as ABC is about to complete and the new, impulsive struct GBPUSD - No comments.

USDJPY - No comments. Trading Plan - No comments. EURUSD - No comments. NASDAQ Ellitot Wave Analysis on Daily Timeframe. Nasdaq - No comments. How is the bubble in Bitcoin? Bitcoin - No comments.

EURJPY - No comments. SP Elliott Wave Analysis on H4 Timeframe. SP - No comments. SP Elliott Wave Analysis On H2 Timeframe. Pre-NFP Payrolls Trading Plan. USDCAD - No comments. AUDUSD - No comments. Crude Oil Analysis on H1 Timeframe. Crude Oil - No comments. TradingView wchodzi do Polski!

Trading plan and global macro analysis for