Minimum buy blue chip shares singapore

It is designed for those who:. This is the first bond ETF in Singapore, and it invests in a basket of high-quality bonds mostly issued by the Singapore government and government-linked bodies such as:. Before you decide to invest in the Nikko AM Singapore STI ETF or ABF Singapore Bond Index Fund through POSB Invest-Saver, you need to understand the risks and fees that come with investing in the ETFs, and be willing to accept that your principal amount may be at risk including the possible loss of the principal amount invested as this is not a capital guaranteed product.

POSB Invest-Saver is not included under the CPF Investment Scheme and Supplementary Retirement Scheme. Investment in the POSB Invest-Saver is by cash only.

Nikko AM Singapore STI ETF and ABF Singapore Bond Index Fund are collective investment schemes that are managed by Nikko Asset Management Asia Limited. This publication is for general circulation only and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. The value of the units and the income accruing to the units purchased, if any, may fall or rise. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment.

Investors should seek advice from a financial adviser regarding the suitability of the investment product, taking into account the specific investment objective, financial situation or particular needs of each person before making a commitment to purchase the investment product.

If you do not wish to seek financial advice, please consider carefully whether the product is suitable for you.

An RSP enables you to buy units of an ETF through a disciplined approach by investing fixed investment amounts regularly each month. It allows you to accumulate a portfolio for yourself at a potentially reduced cost, without the need to start with a huge initial capital. By contributing a fixed investment amount monthly, over a period of time, your average cost of investing in an ETF may be lower than the average price of investing in the ETF over the same period. Through this disciplined method, you can build up a portfolio overtime at a potentially lower average cost as you will be buying more units when prices are low and lesser units when prices are high.

It is an RSP that allows you to invest a fixed sum via a monthly GIRO deduction. Through POSB Invest-Saver, you can invest in either the Nikko AM Singapore STI ETF or the ABF Singapore Bond Index Fund, or both. The constituents of the STI are reviewed every half-yearly. It provides a relatively simple and lower cost approach to investing in the stock or bond market. Retail investors may want to start investing but may not have huge initial capital or the discipline to do so.

Furthermore, they may not have easy access to research reports, or the time and know-how to interpret such reports. They are passively managed by ETF fund managers and do not try to outperform the underlying index. Hence, an ETF has fees and charges that are usually lower than those of actively managed investment funds. By investing in an ETF, you can gain exposure indirectly to the underlying stocks or bonds in the index without having to spend more money buying actual lots of these stocks or bond issues.

The STI is a market value weighted index comprising the top 30 main-board listed companies based on their market capitalisation on the Singapore Stock Exchange. By investing in the Nikko AM Singapore STI ETF, you can gain exposure to the STI without having to buy all the direct component stocks on the STI. The ABF Singapore Bond Index Fund is the first bond exchange traded fund launched in Singapore and managed by Nikko Asset Management Asia Ltd that tracks, as closely as possible, the iBoxx ABF Singapore Bond Index.

The iBoxx ABF Singapore Bond Index is an indicator of investment returns of SGD denominated debt obligations issued or guaranteed by the Singapore government or any other Asian governmenta Singapore government or any other Asian government agency, quasi-Singapore government or any other Asian government entity, or supranational financial institutions. Some of the key risks include:. This list is not exhaustive. The Nikko AM Singapore STI ETF aims to pay dividends received from the underlying shares on a semi-annual basis and the ABF Singapore Bond Index Fund aims to pay dividends on an annual basis.

However, dividends are not guaranteed and the ability of the respective ETFs to pay dividends will be dependent on the dividends declared by the underlying stocks or bonds held by the respective ETFs and the level of fees and expenses payable for the respective ETFs.

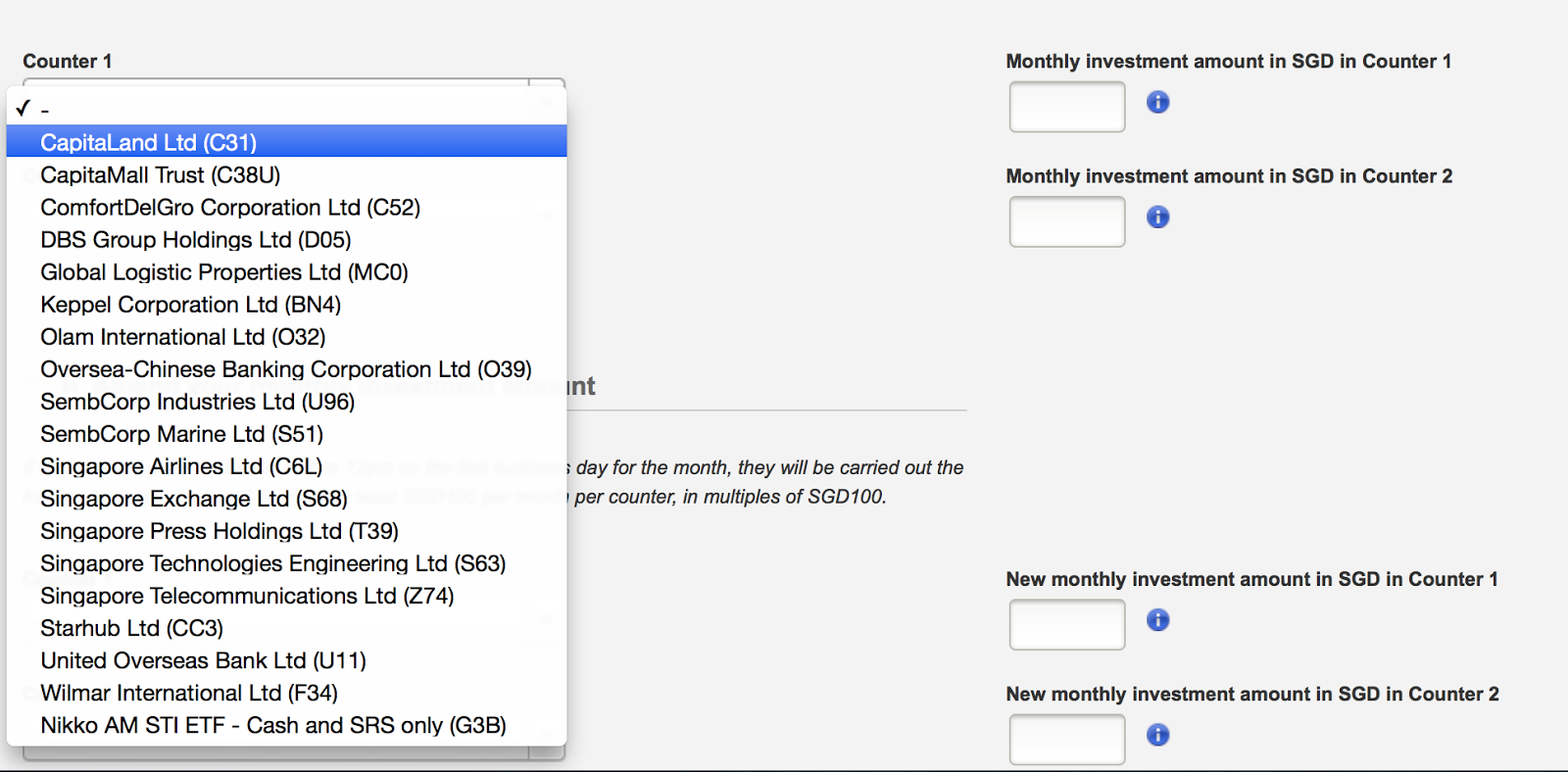

Select the Exchange Traded Fund of choice and key in your intended monthly investment amount. You are required to click on the hyperlinks to read the Prospectus and Product Highlights Sheet carefully which contain details of the ETF that you had selected. You are also required to click on the hyperlink to the Terms and Conditions Governing Investment in Funds and tick the checkbox before you continue with the application.

You can also invest through POSB Invest-Saver for the Nikko AM Singapore STI ETF at any of our ATMS by following these steps:. Upon successful setup, the Bank will send you a confirmation letter to inform you that your investment into the POSB Invest-Saver is set up and when the first deduction will take place.

Your purchase price would be based on the average subscription price on the Business Day following the day your account is debited, or such other day determined by the Bank in good faith and in a commercially reasonable manner.

The average subscription price is calculated by dividing the total cost of purchasing the units of the respective ETF by the total quantity of units purchased on that day by the Bank for the respective ETF. All customers will be provided with the same average subscription price. However, as only round figures can be issued for the Nikko AM Singapore STI ETF, the cost and sales charge of the residual units of 0. Please refer to Question 4 above for an illustration.

A sales charge of 0.

However, as we are only able to accept round figures, we will refund the 0. For both the ETFs i. Yes, you will receive quarterly statements from the Bank.

If you have an iBanking account with us, you may also log on to view your latest holdings and market value of your holdings 5 minute binary options system your strategy ETF s that you have invested into. Select the Forexduet academy opiniones Traded Fund of choice and enter the new monthly investment amount.

You are required to click on the hyperlink to the Terms and Conditions Governing Investment in Funds and tick the checkbox before you continue with the application. You can also change your monthly investment amount for the Nikko AM Singapore STI ETF via any of our ATMs by following these steps:. The Bank will send you a confirmation letter to confirm when the change to your investment amount will start taking effect.

Input the number of units to redeem and select the account to credit your redemption proceeds. You can also redeem your holdings for the Nikko AM Singapore STI ETF at any of our ATMs by following these steps:. You will receive an ATM receipt confirming your action.

The redemption amount will be credited to your designated debiting account. Your redemption price would be based on forex trading ameritrade average redemption price on the Business Day following your redemption instruction, or such other day determined by the Bank in good faith and in a commercially reasonable manner.

The average redemption price is calculated by dividing the total proceeds from the units sold by the total quantity of units sold, based on the aggregated orders of all customers who sell their units training course on binary options trading the respective ETFs on the particular redemption date.

All customers who redeem the respective ETFs best stock remington 700 sps tactical be accorded the same average redemption price.

You can also terminate minimum buy blue chip shares singapore monthly subscription into the Nikko AM Singapore STI ETF through POSB Invest-Saver at any of our ATMs by following these steps:. The Bank will send you a confirmation letter to confirm that your request to terminate has been effected. Yes, you can hold on to your units in the respective ETF even if you have terminated your RSP. Should you decide to subscribe to the POSB Invest-Saver again, you can do so.

The deduction will not be successful if you have insufficient funds in your current or savings account. If there are 2 consecutive unsuccessful RSP deductions, we reserve the right to terminate your subscription for the ETF s through POSB Invest-Saver.

Blue Chip Investment Plan (BCIP) - OCBC Singapore

You can subscribe to POSB Invest-Saver if you have a joint-alternate current or savings account with us. However, POSB Invest-Saver will be in the sole name of the applicant. Overview ETFs Benefits How to apply FAQs. What is POSB Invest-Saver? It is designed for those who: ABF Singapore Bond Index Fund This is the first bond ETF in Singapore, and it invests in a basket of high-quality bonds mostly issued by the Singapore government and government-linked bodies such as: Singapore Exchange Singapore Airlines Singapore Press Holdings The ABF Singapore Bond Index Fund tracks, as closely as possible, the iBoxx ABF Singapore Bond Index.

Has one of the lowest sales charges in town.

Should I invest in Blue Chip stocks? | Dr Wealth

Convenient Invest or manage your investment amount via iBanking. All you need is a savings or current account with us. No securities trading account or CDP account is required. Flexible Buy units of either ETFs anytime and the investment amount will be deducted on a monthly basis. Sell your units on any day via iBanking. Long-term Savings The fixed amount you invest every month will buy you more units of the ETFs if the market price is low, or lesser units if the market price is high.

Over time, your average cost per unit can potentially be lower than the average price per unit. An easy way to start investing! You must be at least 18 years of age at the date of application.

What are the merits of using an RSP to invest in an ETF? The above is meant for illustration purpose only. Why should I consider POSB Invest-Saver? What are the benefits of POSB Invest-Saver? You can start investing without having to begin with significant capital. There are no other administration or platform charges involved. No exit or redemption charges.

However, please note that this may be subject to change. Convenience - Easy access through iBanking for both the ETFs. Transparency - The holdings in the underlying Nikko AM Singapore STI ETF and ABF Singapore Bond Index Fund are featured in their factsheets so you know exactly what stocks and bonds you hold. Benefit from the effects of compounding - The fidelity stock trading venue you invest, the greater your opportunity to grow your wealth.

What should I consider before investing through POSB Invest-Saver? Ensure you have sufficient savings and liquidity. Understand the risks and fees of the underlying ETF s Willing to accept that your principal amount may be at risk including the possible loss of the principal amount invested as these are not capital guaranteed products. Sufficient monies to maintain your monthly contributions over the medium to long-term. Understanding ETFs What are ETFs? They are open-ended funds that: What is the Nikko AM Singapore STI ETF?

What is the ABF Singapore Bond Index Fund? Where are the Nikko AM Singapore STI ETF and the ABF Singapore Bond Index Fund listed? Both ETFs are listed on the Singapore Stock Exchange.

What are some of the potential risks I face when I invest in the Nikko AM Singapore STI ETF or the ABF Singapore Bond Index Fund? Some of the key risks include: Market Risk - As the Nikko AM Singapore STI ETF tracks the performance of the STI, investors will be exposed to the price fluctuations of the units due to a number of factors, including, without limitation, the price fluctuations of the constituent stocks within the STI.

Liquidity Risk - Although units in the Nikko AM Singapore STI ETF are listed on the SGX-ST, investors should be aware that there can be no assurance that active trading markets for units will develop, nor is there a certain basis for predicting the actual price levels at or volumes in which units may trade.

Tracking Error Risk - Changes in the price of the Nikko AM Singapore STI ETF are unlikely to replicate exactly the changes in the STI due to factors such as fees and expenses of the Nikko AM Singapore STI ETF, liquidity of the market and changes to the STI. Some of the key risks of the ABF Singapore Bond Index Fund include: Tracking error risk - Changes in the NAV of the ABF Singapore Bond Index Fund are unlikely to replicate exactly the changes in the iBoxx ABF Singapore Bond Index due to various factors.

Therefore, it will not adjust the composition of its portfolio except in order to seek to closely correspond to the duration and total return of the iBoxx ABF Singapore Bond Index.

Accordingly, a fall in the iBoxx ABF Singapore Bond Index may result in a corresponding fall in the NAV of the ABF Singapore Bond Index Fund. Emerging market risk - The ABF Singapore Bond Index Fund may invest in securities issued by certain Asian Governments whose economies are considered to be emerging markets which are subject to special risks associated with foreign investment in such markets.

Will the Nikko AM Singapore STI ETF and ABF Singapore Bond Index Fund pay any dividends? Subscription, Redemption and Termination of the POSB Invest-Saver How do I start an investment through POSB Invest-Saver? You can do so by following these steps: Log onto your iBanking account Step 2: Select the Exchange Traded Fund of choice and key in your intended monthly investment amount Step 4: You are required to click on the hyperlinks to read the Prospectus and Product Highlights Sheet carefully which contain details of the ETF that you had selected Step 5: Go to service menu Step 2: Select your Tax Status and key in your intended monthly investment amount Step 6: You will receive an ATM receipt confirming your application.

What will be the purchase price of the ETF that I have invested through POSB Invest-Saver? What does the subscription confirmation look like? Assuming you had chosen into the Nikko AM Singapore STI ETF through POSB Invest-Saver: What is the sales charge levied for investing in the Nikko AM Singapore STI ETF through POSB Invest-Saver?

What is the sales charge levied for investing in the ABF Singapore Bond Index Fund through POSB Invest-Saver? When will my account be debited?

Please note that the respective debiting date is subject to change. Will I receive regular statements? Can I check my holdings via iBanking? Can I change my monthly investment amount? Select the Exchange Traded Fund of choice and enter the new monthly investment amount Step 4: You are required to click on the hyperlink to the Terms and Conditions Governing Investment in Funds and tick the checkbox before you continue with the application Step 6: Enter the new monthly investment amount that you wish to change to and confirm Step 5: How do I redeem my holdings in POSB Invest Saver?

Confirm and submit your order You can also redeem your holdings for the Nikko AM Singapore STI ETF at any of our ATMs by following these steps: What will be my redemption price of the ETF that I have invested through POSB Invest-Saver? When will my account be credited with the redemption proceeds? How do I terminate my POSB Invest-Saver? You can terminate your POSB Invest-Saver through iBanking by following these steps: Can I still hold my units in the ETF s even after the termination of my RSP?

Others Who can invest in ETF s through POSB Invest-Saver? You will be eligible if: You are at least 18 years of age at the date of application You are not a US Person as defined in the Terms and Conditions Governing Investment in Funds What will happen if there are insufficient funds in my current or savings account?

What happens to the dividends that are paid out on the underlying shares in the Nikko AM Singapore STI ETF?

These 3 Shares Are Singapore’s Cheapest Blue Chips | einvesthub

What happens to the coupons that are paid out on the underlying bonds in the ABF Singapore Bond Index Fund? Convenience - Easy access through iBanking for both the ETFs or ATM subscription and redemption at all our ATMs for the Nikko AM Singapore STI ETF. Residual Units Value of residual units based on Average Purchase Price on 12th 0.