Aim listed companies by market capitalisation

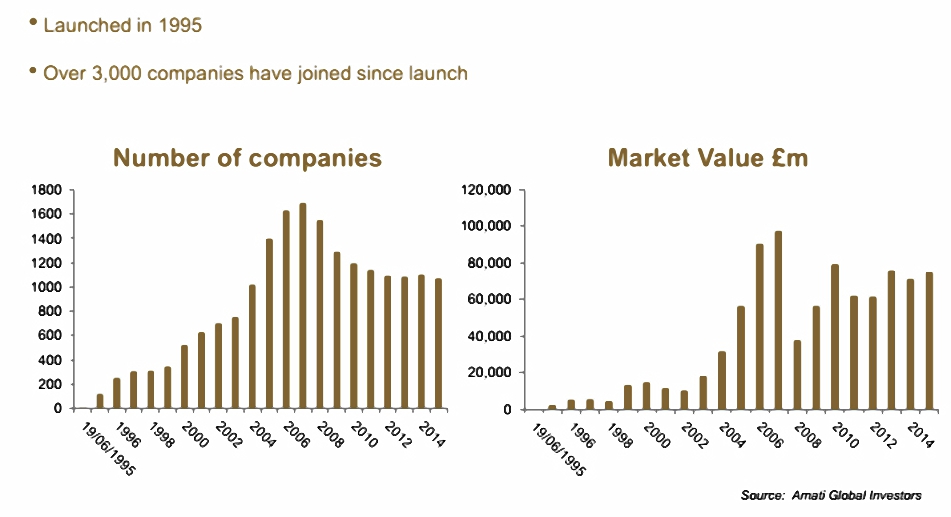

At the end of there were companies quoted on AIM, down from a high of 1, at the end of Research by UHY Hacker Young shows that companies left the market in , with 46 delistings caused by financial stress or strategy failure. But the falling numbers don't all point to bad news. A decline in the value of sterling last year meant that UK companies were more attractive as takeover targets for foreign firms.

On UHY's numbers, 34 companies were acquired from AIM in , up from 28 a year earlier - and the figures rose sharply in the final quarter. Overall, the latest statistics show that the number of AIM companies has been falling for two main reasons.

Firstly, poor quality firms continue to die off at a high rate. Secondly, good quality firms that may appear cheap to trade buyers are being snapped up. For investors, it's quite clear that poor quality should be avoided.

The makeup of AIM has changed a lot over the past 10 years.

In the mids it was dominated by oil and mining companies. These days it's a different picture. There are still stocks in the oil and basic materials sectors. In other words, the influence of the resources sectors on the performance of AIM has been slashed over the past decade. Instead, the largest sector on AIM now is consumer services, which covers retail, media and travel.

In turn, industrials, consumer goods and healthcare all have much greater weight in the market. Look for decent profitability, improving financial strength and defendable business models So there might be fewer stocks on AIM now, but the market is arguably better balanced as a result.

But that doesn't mean that all the problems have gone away. After all, insolvencies are an investment nightmare.

Is a bubble starting to form in parts of the Aim market? | Money Observer

With that in mind, we're kicking off our series for Interactive Investor in with a look at AIM companies with some of the strongest combined quality and momentum. These stocks are often referred to as "high flyers". But anyone can take this approach by looking for decent profitability, improving financial strength and signs of defendable business models. These stocks should also have the wind in their sails, with rising prices and encouraging analyst sentiment behind them.

Small-cap high flyers are not infallible, and their size can make them vulnerable to setbacks. Even so, positive quality and momentum characteristics have historically tended to drive outperformance in the stock market over the longer term. A focus on quality and momentum picks up shares across a range of sectors and market caps on AIM.

FAIRPOINT GROUP share price (FRP) - London Stock Exchange

It's vital to note that smaller companies with limited resilience can be hit hard by unexpected events. So detailed research into individual AIM companies is essential.

The fabric of the junior market has changed a huge amount over the past decade. In that time, the focus of attention has switched away from speculative sectors towards industries where it's easier to judge the potential quality of an investment. While it's generated some incredible winners, AIM would certainly benefit from a few more, which would likely encourage more companies to join it.

Interactive Investor's Stock Screening series is written by Ben Hobson of Stockopedia.

AIM Statistics - London Stock Exchange

You can click here to read Richard Beddard's review of Stockopedia. It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision. Ben Hobson is Investment Strategies Editor at Stockopedia.

His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.

He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook". This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Interactive Investor is the web's biggest community for discussing UK investments and companies. Compare strategies, share knowledge and validate decisions or not on our discussion boards. Interactive Investor Trading Limited, trading as "Interactive Investor", is authorised and regulated by the Financial Conduct Authority. Standon House, 21 Mansell Street, London E1 8AA, telephone Registered in England with Company Registration number Group VAT registration number This is to protect both of us and for training purposes.

Calls to this number cost no more than calls to 01 and 02 numbers.

Are these the 10 best shares on AIM? By Stockopedia and Ben Hobson Wed, 11th January - The high street's not dead: The retail stocks to own.

Share Views - Ep.17 - Get ahead; access to AIM-listed companies at a discountAmbitious Boohoo still a buy despite 'prohibitive' valuation. Recent Features A 'magic formula' for patient investors. What to make of Sky at six-month low. Here's why the eight-year long bull market still has legs. Charting the way back for Laura Ashley.

Most-read this week The FTSE shares Neil Woodford just bought. The 10 investment trusts I have picked for my pension portfolio. Woodford stunned by Provident Financial crash. The case for investing in Woodford Patient Capital. Our Services Our Accounts Share and Fund Account ISAs Why us? Search by Manager Group Allianz Global Investors Baillie Gifford BlackRock ETF Securities Fidelity GAM Janus Henderson Investors Invesco Perpetual iShares by BlackRock J.

Morgan Asset Management Witan Investment Trust Unicorn All Manager Groups More Articles A 'magic formula' for patient investors.

The high-yielding trusts more popular than ever. Why confidence in this retailer is at a five-year high. Names to watch as IPO pipeline hots up. Record-breaking RWS is reassuringly expensive. Search Search this site: Sign in My Portfolio. RSS Mobile About us Our network Money Observer Moneywise Share Price Contact us Cookies. Information Advertise with us Site map. Connect Contact us Follow us on Twitter Visit us on Facebook RSS feed. Our Services Share and fund account.

Our Products Shares Investment Trusts Bonds and Gilts Exchange Traded Products VCTs Live Share Prices - Level 2 Forex. Popular Pages Portfolio Login to your trading account Markets Contact us.

Secondary links Legal Terms Risk Warning Privacy Security Help.