Dma forex broker uk

Forex DMA refers to electronic facilities that match orders from traders with bank market maker prices. It enables buy-side traders to trade in a transparent, low latency environment. List of ECN Forex brokers: Thanks, appears to be an excellent summary of issues i only vaguely understood. Important to know who is doing what out there in the world of brokers.

Your capital is at risk. Trading on margin involves high risk, and is not suitable for all investors. Before deciding to trade forex or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite. All CFDs stocks, indexes, futures and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes.

They take the opposite side of the trade. When traders want to sell, they buy from them, when traders want to buy, they sell to them Dealing desk brokers are able to profile their clients. They divide clients into groups systematically with algorithm. Broker automatically take the other side. Losing trades of clients are counter-traded and become brokers' profit.

More losing traders means more profit for the broker. Broker automatically take the other side and then hedge the position in the real market that they have access to. This is also done automatically through algorithm. Fixed spreads Makes money through spreads and when a client loses a trade. Price Manipulation is possible. Traders can't see the real market quotes. Transparency of dealing desk brokers differ depending on their own company rules.

DMA Forex brokers | DMA (Direct Market Access)

A ll orders are passed to Liquidity Providers LP directly. No re-quotes and no additional pausing when confirming orders.

Makes money by commission or spreads In the retail fx markets usually there are 2 type of NDD forex brokers: Benefits of No Dealing Desk brokers Anonymity. Clients' orders are executed automatically, immediately and anonymously.

There is no dealing desk watching you orders. Because all Participants or liquidity providers compete for prices in a real market.

With NDD Forex Brokers, LP s are the counterparty to you trades. They take the opposite side of your position, and looking to make money by closing this position later in a trade with another party.

More LPs usually means more depth in the liquidty pool,thus better spreads. Number of Liquidity providers One Liquidity Provider. LP control the price spread. Most STP Brokers has a predetermined number of liquidity providers. ECN brokers have a large number of liquidity providers. STP Forex Brokers STP Forex Brokers don't trade against clients Make money through spreads mark-ups. They add small mark-ups on the best bid and ask rates they get from LPs. For example, adding a pip to the best bid price or subtracting a 0.

Clients' orders are directly sent to a certain number of liquidity providers Banks or Other Brokers More liquidity providers means more liquidity and better fills for the clients.

The fixed spreads they charge are higher than the best quotes they get from LPs. They may use their back-office price matching system to make sure they can make profits on spread difference while hedging the trades with LP s at better rates at the same time.

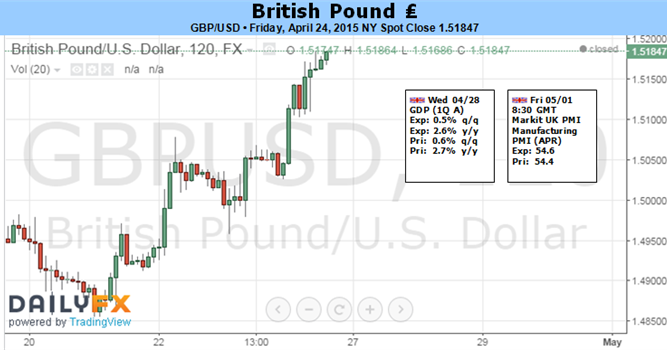

Direct Market Access Forex DMA refers to electronic facilities that match orders from traders with bank market maker prices. Direct access to the market. STP brokers that offer Market execution provide true Direct Market Access DMA Market execution is more transparent. Orders go to the market,and are filled based on available quotes from LPs.

Orders don't go to the market. They are instantly filled by the broker, who then may or may not offset own risks with LPs. Some STP Forex brokers fill clients' orders though Instant execution,after which they hedge these orders with their LPs in order to make profits.

How to Test a Forex Broker To Make Sure They're LegitimateIf there are no profitable hedging opportunities when traders submit their orders,they may experience re-quotes. Orders are facilitated by brokers. The broker is not a market maker or liquidity destination on the DMA platform it provides to clients. Only variable spreads optional: Depth of the market book access DOM access ECN forex brokers always offer DMA, some STP brokers offer DMA STP Forex Brokers that offer DMA: List of STP brokers http: All participants banks, market makers and retail traders trade against each other by sending competing bids and offers into the system.

Allow clients' orders to interact with each other. Orders are matched between counter parties in real time. Participants get the best offers for their trades available at the time. Only variable spreads Makes money only through commission. Display the Depth of the Market DOM in a data window. Then can see where the liquidity is. ECN Benefit Anonymous trading environment. Straight through processing with banks liquidity.

All trading styles are welcome Interbanks prices and spreads. Greater number of marketplace participants means tighter spreads.

Greater price transparency, faster processing, increased liquidity. ECN vs STP Brokers with DMA ECN is the most transparent model.

ECN Forex broker provides a marketplace where all its participants trade against each other real time. ECN Brokers charge commission. Both have fractional pricing; Both have DOM Depth of the Market orders book. Traders can choose the one they like. Cents Account or Mini Account of a STP broker is usually the account that has a dealing desk.

Types of Retail Forex Brokers: ECN vs DMA vs STP vs Market Maker - utabumo.web.fc2.com

All small orders by traders usually below 0. So they usually use dealing desk model for this type of account. Usually for orders above 0. Conclusion Dealing desk brokers or Market makers make money on spreads and when clients lose trades. More winning traders will increase the operational risk of a dealing desk broker. No dealing desks brokers are more transparent. They want their clients to win because clients' losses are not their profit,and the more clients trade, the more profit for them through commission or small spread mark-up.

Not all forex brokers will be honest with you,so whether you choose ECN , STP, or market maker,it's important to trade with the broker that has a good reputation.

Leave a Reply Cancel reply Your email address will not be published. ECN vs DMA vs STP vs Market Maker All Forex brokers that accept US Clients Forex regulation and regulated forex brokers list Forex trading platform - Metatrader 4 , Metatrader 5 and other platforms Forex account funding CFD Brokers: Forex brokers offering CFD Forex brokers offering Gold, Silver, Oil Trading.

Experience with this broker.