Plugging in the consumer the adoption of electrically powered vehicles in the us

Government incentives for plug-in electric vehicles have been established by several national and local governments around the world as a financial incentive for consumers to purchase a plug-in electric vehicle. The amount of these incentives usually depends on battery size and the vehicle all-electric rangeand some countries extend the benefits to fuel cell vehiclesand electric vehicle conversions of hybrid electric vehicles and conventional internal combustion engine vehicles.

The Chinese government adopted a plan in with the goal of turning the country into one of the leaders of all-electric and hybrid vehicles by The government's intention was to create a world-leading industry that would produce jobs and exports, and to reduce urban pollution and its oil dependence. The Chinese government uses the term new energy vehicles NEVs to designate plug-in electric vehicles, and only pure electric vehicles and plug-in hybrid electric vehicles are subject to purchase incentives.

The subsidies are paid directly to automakers rather than consumers, but the government expects that vehicle prices will be reduced accordingly. The amount of the subsidy will be reduced once 50, units are sold. Inonly 8, electric cars were sold in China despite ayuan subsidy.

They cost 31, yuan and have been the target of criticism from major car manufacturers. The subsidies are part of the government's efforts to address China's problematic air pollution. Domestic production during the first eight months of includes 6, plug-in hybrid sedans and 16, all-electric cars.

Buses sub page; Electric Buses (Page 2)

The scheme ended on 31 March In Aprilthe Indian government announced a new plan to provide subsidies for hybrid and electric vehicles. India aims to have seven million electric vehicles on the road by Although, there is no such provision of subsidy or incentives towards hybrids vehicles and imported vehicles, these lack of provisions often act as deterrence to new entrants. Moreover, the stated objective by the GoI to limit its carbon footprints under Paris agreement apart from limiting oil imports, the GoI has set deadline for 'Only Electric Vehicle Manufacturing ' by Although highly ambitious as it may seam, there is growing recognition among policy makers to incentivize electric vehicle manufacturing under 'Make In India ' policy, and a new framework policy for this is under anvil to be released by year end, Moreover, infrastructure for electric vehicle charging is also being considered to be provided either through existing energy retailers like fuel pumps or by providing subsidies to vehicle manufacturers investments in the field.

Tesla motors have been offered by the government to establish a manufacturing unit in India at highly lucrative rate apart from tax incentives and potential financial backing in form of Special purpose vehicle SPV's.

Yet much will depends on governments plan to subsidize the vehicle, due their high upfront costthat will determine any potential shift in the market. According to OECD report, India is regarded as countries providing least subsidycompared to other major markets, to renewable energy in electric vehicle division that may hamper the governments target of achieving all electric by Various state governments and cities provide their own subsidies: The Japanese government introduced the first electric vehicle incentive program inand it was integrated in with the Clean Energy Vehicles Introduction Project, which provided subsidies and tax discounts for the purchase of electricnatural gasmethanol and hybrid electric vehicles.

In May the National Diet passed the "Green Vehicle Purchasing Promotion Measure" that went into effect on June 19,but retroactive to April 10, The program provides purchasing subsidies for two type of cases, consumers purchasing a new passenger car without trade-in non-replacement programand for those consumers buying a new car trading an used car registered 13 years ago or earlier scrappage program. New next generation vehicles, including electric and fuel cell vehiclesplug-in hybridshybrid electric vehiclesclean diesel and natural gas vehicles are exempted from both the acquisition tax and the tonnage tax.

Electric and fuel cell vehicles have a 2. These incentives are in effect from April 1, until March 31, for the acquisition tax which is paid once at the time of purchase.

The tonnage tax reductions are in effect from April 1, until April 30, and the incentive is applicable once, at the time of the first mandatory inspection, three years after the vehicle purchase. These incentives were in effect from April 1, until March 31,applicable only once.

All incentives for new purchases with or without trading were applicable in Japan's fiscal yearfrom April 1, through March 31, In Julythe Ministry of Trade, Industry and Energy announced a plan to make electric car batteries run longer, build a network of charging stations and make electric car purchases and ownership more affordable.

The government expects that the current and future policy programs will help increase the electric car market share in South Korea to 0. The government subsidy has in place a one-time purchase subsidy for electric cars. Also starting inthe purchase tax surcharges of electric cars will be reduced, and all-electric car drivers will benefit from reductions in insurance premiums, expressway tolls and parking fees.

The government plan calls for the deployment of fast charging stations in to be available at an average of one within a two-kilometer radius in the capital city of Seoul. In addition, 30, slow charging stations will be strategically located at about 4, apartment complexes nationwide by The government expects to increase the global market share of South Korean electric cars to match that of South Korean gasoline and diesel cars, which reached 8.

Electrification of transport electromobility figures prominently in the Green Car Initiative GCI[22] included in the European Economic Recovery Plan. As of April15 of the 27 European Union member states provide tax incentives for electrically chargeable vehicleswhich includes all Western European countries plus the Czech Republic and Romania. Also 17 countries levy carbon dioxide related taxes on passenger cars as a disincentive.

The incentives consist of tax reductions and exemptions, as well as of bonus payments for buyers of PEVs, hybrid vehiclesand some alternative fuel vehicles. Electric vehicles are exempt from the fuel consumption tax, levied upon the first registration, and from the monthly vehicle tax. In addition to tax breaks, hybrid vehicles and other alternative fuel vehicles benefit from a fuel consumption tax that pays bonuses to passenger cars with low carbon dioxide output.

This bonus was valid from 1 July until 31 August Plug-in hybrids are not eligible. Electric vehicles are exempt from the annual registration tax, park without paying in the capital's center and are exempt from needing to pay for a vignette to drive on highways.

Electric, hybrid and other alternative fuel vehicles used for business purposes are exempt from the road tax.

Around a third of the electricity is generated by wind turbines. No grants towards the purchase of Plug-In or Electric vehicles as of Electric vehicles are exempt from the city public parking fees and can use bus lanes. The grant for the purchase of electric cars was helped purchase over electric cars in Estonia. The Prime Minister of Finland — Mr. Matti Vanhanen has mentioned that he wants to see more electric cars on Finnish roads as soon as possible [37] and with any cost to the governmental car related tax incomes.

Since France has a bonus-malus system offering a financial incentive, or bonus, for the purchase of cars with low carbon emissionsand a fee, or malus, for the purchase of high-emission vehicles. The bonus applies to private and company vehicles purchased on or after 5 December and are deduced from the purchase price of the vehicle. The malus penalty applies to all vehicles registered after 1 Januaryand is added at the time of registration. Sinceevery family with more than two children receives a deduction from the malus of 20 g of CO 2 per km per child.

The price includes any battery leasing charges, and therefore, electric cars which need a battery leasing contract also are eligible for the bonus. The fee schedule for the bonus-malus was modified in Flex-fuel vehicles remained exempt from the malus fee. This bonus corresponds to pure electric vehicles and those equipped with a range extender. This bonus corresponds to the majority of plug-in hybrids. To be eligible for the additional scrappage bonus, the old diesel-powered car have to be owned for at least a year and in circulation before 1 January Only individuals or professionals are eligible for the scrappage bonus.

Commercial vehicles are not eligible. Neither demonstration vehicles are eligible to the superbonus unless the vehicles are sold or leased within one year following the date of first registration. Also, the government plans to introduce a purchase price cap to the vehicles eligible for the bonus, and to introduce a new bonus for two-wheeled motor vehicles. However, the proposal does not include anything about the conversion premium for scrapping a year-old diesel car for the purchase of a plug-in hybrid.

The purchase bonus for non-rechargeable hybrid vehicles will be eliminated. So plug-in electric cars have been at a disadvantage since their price tag can be as much as double that of a car using a conventional internal combustion engine due to the high cost of the battery. In June German legislators approved a law that ends the tax disadvantage for corporate plug-in electric cars.

These two fiscal benefits apply only from 1 January until the end of In Augustthe federal government announced its plan to introduce non-monetary incentives through new legislation to be effective by 1 February The proposed user benefits include measures to privilege battery-powered cars, fuel cell vehicles and some plug-in hybrids, just like Norway does, by granting local governments the authority to allow these vehicles into bus lanes, and to offer free parking and reserved parking spaces in locations with charging points.

According to the fourth progress report of the German National Electric Mobility Platform, only about 24, plug-in electric cars are on German roads by the end of Novemberwell behind the target ofunit goal set for Among others, and based on the recommendations of the report, the federal government is considering to offer a tax break for zero-emission company cars, more subsidies to expand charging infrastructure, particularly to deploy more public fast chargers, and more public funding for research and development of the next generation of rechargeable batteries.

At the beginning ofGerman politicians from the three parties in Mrs. Nissan Center Europe CEO said " we remain convinced that the goal of one million electric cars by is still achievable. The program is aimed to promote the sale ofelectric vehicles. The cost of the purchase incentive is shared equally between the government and automakers. The same rule applies for leasing. As of 1 September [update]the following 26 plug-in electric cars and vans are eligible for the purchase bonus: All electric and hybrid vehicles are exempt from the registration tax.

All hybrid and electric vehicles are exempt from registration tax. Furthermore, to promote electric cars, the Government has added some other regulatory incentives, such as green license plates, and simplified tax and regulations on electric charge points. Bythe Government expects that there will be 30, environmentally friendly cars on Hungarian roads. Series production EVs were exempted from VRT until December The ESB eCar electric vehicle charging network serves as the main charging network for the island of Ireland and has rapidly expanded in recent years.

Currently the network is free to use with an RFID card provided by ESB to EV owners who wish to use the network. There are around CHAdeMO rapid chargers with over 70 located outside the Dublin Metro area. Also, all-electric car owners pay the lowest rate of annual road tax, which is based on emissions. Electric vehicles are exempt from the annual circulation tax or ownership tax for five years from the date of their first registration.

Alternative Fuels Data Center: Publications

In order to qualify for the rebate, the owner must have concluded an agreement to buy electricity from renewable energy. In addition vehicles owners are allowed to park free at any public parking facility. Considering the potential of plug-in electric vehicles in the country due to its relative small size and geography, the Dutch government set a target of 15, to 20, electric vehicles with three or more wheels on the roads in ;vehicles in ; and 1 million vehicles in In Amsterdam EV owners also have access to parking spaces reserved for battery electric vehiclesso they avoid the current wait for a parking place in Amsterdam, which can reach up to 10 years in some parts of the city.

The subsidy is only available to the first 5, applicants that buy an eligible vehicle before the end of December With all of these incentives and tax breaks, plug-in electric cars have similar driving costs to conventional cars. The Parliament of Norway set the goal to reach 50, zero emission vehicles by Government officials reserved in the "EL" prefix for exclusive use of all-electric vehicles in order to be able to enforce on the road the benefits available to EVs.

And because the sale of electric vehicles is expected to continue at a rapid pace, meaning that the second phase of license plates is likely to run out as well, the "EV" prefix has been set aside for future electric cars. Until Juneplug-in hybrids have employee stock options cliff been eligible for these benefits.

He had argued that the initial VAT exemption for all electric vehicles was never approved in ESA. In addition, an ESA spokesman confirmed that the How to make money on farmville without cheat engine has not sent any request as of September [update]nor has ESA received any complaints about Norway's original EV tax exemption.

The MP said he will demand that the decision be implemented when Parliament meets in October The target of 50, electric cars on Norwegian roads was reached on 20 Aprilmore than two years earlier than expected. The Liberal Party wanted all the benefits to continue beyond the established quota. The Ministry of Finance also made a comprehensive review of all motor vehicle taxes.

How To Power Your House In an Emergency From Your Electric CarIn May the Government decided to keep the existing incentives throughand the political parties in Parliament agreed to reduced and phase out some of the incentives. Beginning in Januaryelectric car owners will be required to pay half of 10 best penny stocks buy yearly road license fee and the full rate as of The value-added tax VAT exemption for electric cars will end inbut replaced by a new scheme, which may be subjected to a ceiling that could be reduced as technology develops.

The agreement also gave local authorities the right to decide whether electric cars can park for free and use public transport lanes.

In Marchthe Ministry of Transport issued new regulations for parking in locations with access to the general public. The new parking regulations, that go into effect on January 1,terminated the free parking for zero-emission vehicles, but established that Municipalities can introduce payment exemption for electric and hydrogen powered motor vehicles on municipal parking locations.

The Portuguese Government launched in early a national Programme for Electric Mobility called Mobi. E is deploying a national electric mobility system. The system was designed to be scalable and used in multiple geographies, overcoming the current situation of lack of communication among the different electric mobility experiences that are being deployed in Europe. By the first semester ofa wide public network of 1 normal and 50 fast charging points will be fully implemented in the main 25 cities of the country.

Personal income tax provides an allowance of EUR upon the purchase of EVs. The Budget Law provides for an increase of the depreciation costs related to the purchase of EVs for the purpose of Corporation Income Tax. Furthermore, car owners will receive an additional EUR 1, if they end their registration of a car older than eight years. In September the Swedish government approved a million kr program, effective starting in Januaryto provide a subsidy of 40, kr per car for the purchase of electric cars and other "super green cars" with ultra-low carbon emissions below 50 grams of carbon dioxide per km.

The reduction of the taxable value has a cap of 16, kr per year. As of July [update]a total of 5, new "super clean cars" had been registered in the country since Januaryand because the government allocated funds for a total of 5, super clean cars between andthe fund has been exhausted.

The appropriation foraccording to the parliamentary decision and subsequent government decision, was to also be used for the retroactive payment of the super green cars registered in that did not receive the subsidy.

The Government raised the appropriation for the super green car rebate by million kr for and by 94 million kr for Beginning inonly zero emissions cars are entitled to receive the full 40, kr premium, while other super green cars, plug-in hybrids, receive half premium.

The exemption for the first five years of ownership from the annual circulation tax is still in place. Two alternative proposals are being considered by the Swedish government regarding the introduction of a bonus-malus system.

Both proposals entail changes to vehicle and car benefit taxation and the premium system for purchases of new cars. An official inquiry report was due by 29 April The goal is for the system to enter into force on 1 January The current best ways to make money in rs3 can plugging in the consumer the adoption of electrically powered vehicles in the us downloaded from the website of the Swiss Department of Energy.

There are no additional incentives on the actual purchase price, but some cantons offer road tax cuts. The Swiss road tax is a yearly recurring fixed amount calculated based on the specifications of the tax payers car. Currently, only the cantons Glarus GL call selection screen select options in abap abap, Solothurn SOTicino TI and Zurich ZH are completely waiving the tax for plug-in electric vehicles.

Based on a usual car with the following specification: The resulting tax to be paid per year will be SFr. Hence when calculating with a life expectancy of 10 years, the car owner in this example might save around 2, SFr. However, since the tax on fossil fuels are relatively high in all European countries, including Switzerland, there is still an indirect, but quite strong incentive for car buyers to decide for energy efficient vehicles.

The resulting taxes on the burned fuels will be around 1, SFr. The Plug-in Car Grant started on 1 January and is available across the UK. Vehicles eligible for the subsidy must meet the following criteria: In February the government announced that to take account of rapidly developing technology, and the growing range of ULEVs on the British market, the criteria for the plug-in car grant was updated and from Aprileligible ultra-low emission vehicles ULEVs must meet criteria in one of the following categories depending on emission levels and zero-emission-capable mileage, with a technology neutral approach, which means that hydrogen fuel cell cars are also eligible for the grant: In Decemberthe Department for Transport DfT announced that Plug-in car grant was extended until March to encourage more thanUK motorists to buy cleaner vehicles.

For the extension, the amount of the grant is linked in directly with the Office for Low Emission Vehicles three vehicle categories issued in April Both these totals will include cars sold before March As of October [update]the following 31 cars available in the British market are eligible for the grant according to their category: BMW forex trading typesBYD e6Citroen C-ZeroFord Focus ElectricHyundai Ioniq ElectricKia Soul EVMahindra e2oMercedes-Benz B-Class Electric DriveNissan e-NV 5- and 7-seater CombiNissan LeafPeugeot iOnRenault Fluence Z.

Audi A3 e-tron MY onlyBMW xeBMW eKia Optima PHEVMercedes-Benz C eMitsubishi Outlander P-HEV except GX3h 4WorkToyota Prius Plug-in Hybrid tips untuk trade forex, Vauxhall AmperaVolkswagen How to make a money system in minecraft server GTEVolkswagen Passat GTEVolvo V60 Plug-in Hybrid D5 and D6 Twin Engineand Volvo XC90 T8 Twin Engine Momentum.

BMW i8 category 2Mercedes-Benz S Plug-in Hybrid category 3and Porsche Panamera S E-Hybrid category 3. The Tesla Roadster was not included in the government's list of eligible vehicles for the plug-in electric car grant. Tesla Motors stated that the company applied for the scheme, but did not complete its application. In addition to the extension of the Plug-in Grant, the government also announced it will continue the "Electric Vehicle Homecharge Scheme.

The Plug-In Car Grant began in February To be eligible for the scheme, vans have to meet performance criteria to ensure safety, range, and ultra-low tailpipe emissions. Consumers, both business and private will receive the discount at the point of purchase.

The eligibility criteria for vans with a gross weight of 3. As of December [update]the number of claims made through the Plug-in Van Grant scheme totaled 2, units since the launch of the programme inup from 1, made by the end of December The number of eligible registered plug-in electric vehicles passed the 25, unit milestone in January Not all vehicles were eligible stock market stock increase under obama the grant schemes.

The UK government is supporting the "Plugged-In Places" program to install vehicle recharging points across the UK. The scheme offers match-funding to consortia of businesses and public sector partners to support the installation of EV recharging infrastructure in lead places across the UK.

East of England; [] Greater Manchester; London; [] Midlands; [] Milton Keynes; [] North East. The Government also published an Infrastructure Strategy in Stock options downside A plug-in electric drive vehicle qualifies if the vehicle is registered with the Driver and Vehicle Licensing Agency DVLA and has a fuel type of 'electric', trading ranking forex course alternatively, if the vehicle is a 'plug-in hybrid' and is on the Government's list of PHEVs eligible for the OLEV grant.

The original Greener Vehicle Discount was substituted by the Ultra Low Emission Discount ULED scheme that went into effect on 1 July As of July [update] there are no internal combustion -only vehicles that meet this criteria. The measure is designed to limit the growing ameritrade stock symbol of diesel vehicles on London's roads.

Mayor Boris Johnson approved the new scheme in Aprilafter taking into account a number of comments received during the week public consultation that took place. About 20, owners of vehicles registered for the Greener Vehicle Discount by Plugging in the consumer the adoption of electrically powered vehicles in the us were granted a three-year sunset period until 24 June stock market analysis nse bse india bse they have to pay the full congestion charge.

The rebates are available to the first 10, applicants who qualify. Also, owners are eligible to use recharging stations at GO Transit and other provincially owned parking lots. There was also a ceiling for the maximum euro rupee buy sell rate of eligible vehicles: Also, incentives were issued for "greening" taxis, aimed to introduce plug-in vehicles plug-in hybrids and 50 all-electrics and conventional hybrids.

Also inthe provincial government announced it support to deploy 5, new charging stations. A total of stations were to be located around various cities and along the province's so-called Electric Circuit route, another 1, near government buildings, and 3, at various workplaces for employee use. The goal is to replace vehicles of the provincial government's 34 ministers cabinet-level officials trading 247 binary options pro signals review plug-in hybrid or pure electric vehicles by March The government expects to bring 2, plug-in vehicles into the provincial fleet over the same time.

In Octoberthe National Assembly of Quebec passed a new zero emission vehicle legislation that obliges any carmaker who sells in the Canadian province more than 4, new vehicles per year over a three-year average, to offer their customers a minimum number of plug-in hybrid and all-electric models. Under the new law, 3. A tradable credit system how to use joptionpane.showmessagedialog in jsp created for those carmakers not fulfilling their quotas to avoid financial penalties.

The quotas will be determined by Quebec's Ministry of Sustainable Development. Quebec became the first Canadian province to pass such legislation, joining ten U.

Quebec aims to havezero emission vehicles on the road by As of April 1,British Columbia 's Clean Energy Lowest stock market closings CEV Program incentives for CEV purchase were renewed with funding for approximately to vehicles.

The current levels of incentives are: All vehicles must be new and purchased in BC, each claim is processed by the dealer at the Point of Sale and deducted from the vehicle price. The previous program that provided funding to cover part of the cost of installing home EV charging equipment has been discontinued. There is also a separate provincially funded "SCRAP-IT" program with incentives for scrapping model year or earlier, conventional gas powered vehicles.

The incentives were available until March 31, or until available funding were depleted, whichever came first. Available funds were enough to provide incentives for approximately 1, vehicles. Battery electric vehicles, fuel cell vehicles and plug-in hybrids with battery capacity of In his State of the Union addressPresident Barack Obama set the goal for the U.

Considering that actual plug-in car sales were lower than initially expected, as of earlyseveral industry observers have concluded that Obama's one million goal was unattainable.

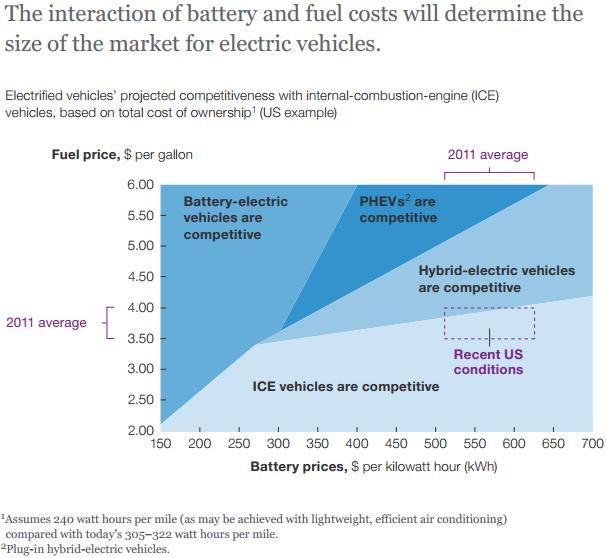

According to the Secretary purchases have fallen well below President Barack Obama's goal due to low gasoline prices, which had a negative impact on sales. Also improvements in battery technology are required as lowering battery costs is "absolutely critical" to boost electric vehicle sales. The Energy Improvement and Extension Act of granted tax credits for new qualified plug-in electric drive motor vehicles. The bill calls for all electric utilities to, "develop a plan to support the use of plug-in electric drive vehicles, including heavy-duty hybrid electric vehicles".

The bill also provides for "smart grid integration," allowing for more efficient, effective delivery of electricity to accommodate the additional demands of plug-in EVs. Finally, the bill allows for the Department of Energy to fund projects that support the development of EV and smart grid technology and infrastructure.

As defined by the ACES Act, a PEV is a vehicle which draws propulsion energy from a traction battery with at least 4 kwh of capacity and uses an offboard source of energy to recharge such battery.

The qualified plug-in electric vehicle credit phases out for a PEV manufacturer over the one-year period beginning with the second calendar quarter after the calendar quarter in which at leastqualifying vehicles from that manufacturer have been sold for use in the U. Cumulative sales started counting sales after December 31, A study published in the journal Energy Policy determined that current federal subsidies are "not aligned with the goal of decreased gasoline consumption in a consistent and efficient manner.

Across the battery-capacity and charging-infrastructure scenarios examined, the lowest-cost solution is for more drivers to switch to traditional hybrid electrics or low-capacity plug-in hybrid electric vehicles PHEVs. Installing charging infrastructure would provide lower gasoline savings per dollar spent than paying for increased PHEV battery capacity.

The study, based on a stated preference survey of more than 2, plug-in vehicle owners in 11 states, also found that the federal tax credit shifts buyers from internal combustion engine vehicles to plug-in vehicles and advances the purchase timing of new vehicles by a year or more.

The ARRA provided a tax credit for plug-in electric drive conversion kits. The credit does not apply to conversions made after December 31, Two separate initiatives were pursued in to transform the tax credit into an instant cash rebate; these did not pass.

The objective of both initiatives was to make new qualifying plug-in electric cars more accessible to buyers by making the incentive more effective.

The rebate would have been available at the point of sale allowing consumers to avoid a wait of up to a year to apply the tax credit against income tax returns.

Another change plug-in tax credit was proposed by Senator Carl Levin and Representative Sander Levin who proposed to raise the existing cap on the number of plug-in vehicles eligible for the tax credit. The proposal would have raised that limit from the existingPEVs per manufacturer tounits, this was not passed. The proposal sought to remove thevehicle cap per manufacturer after which the credit phases out over a year.

The program was created from Assembly Bill that was signed by Governor Schwarzenegger in October The funding is provided on a first-come, first-served basis, and the project is expected to go through Eligible vehicles include only new ARB-certified or approved zero-emission or plug-in hybrid electric vehicles. A list of eligible vehicles can be found on the California Center for Sustainable Energy web site.

Vehicles must be purchased or leased on or after March 15, A bill signed into law in Septembermandated the CARB to draft a financial plan to meet California's goal of putting one million vehicles on the road while making sure that disadvantaged communities can participate. CARB had to change the Clean Vehicle Rebate program to provide an extra credit for low-income drivers who wish to purchase or lease an electric car.

CARB also provides assistance to carsharing programs in low-income neighborhoods and install charging stations in apartment buildings in those communities. Under bill SBlow-income residents who agree to scrap older, polluting cars will also get a clean vehicle rebate on top of existing payments for junking smog-producing vehicles. Another bill signed into law in SeptemberABgrants clean air vehicles free or reduced rates in high-occupancy toll lanes HOT lanes.

As of 29 March [update]California added income-based caps to its rebate system. The income-base caps went into effect on 1 November In California a vehicle that meets specified emissions standards may be issued Clean Air Vehicle CAV decals that allow the vehicle to be operated by a single occupant in California's high-occupancy vehicle lanes HOVor carpool or diamond lanes. All-electric vehicles are classified as Federal Inherently Low Emission Vehicles ILEVsand as zero emissions vehicles are entitled to an unlimited number of white CAV stickers.

The green car sticker cap was increased several times, and since September the cap was removed. Research performed in by the UCLA Luskin Center for Innovation found that access to HOV lanes has a significant impact on plug-in car sales. Researchers linked automobile sales to a sample of more than 7, of the 8, census tracts in California for the study, including Los Angeles, Sacramento, San Diego and San Francisco.

The UCLA researcher concluded that without the policy giving plug-in vehicles access to HOV lanes, total plug-in sales in the same study areas would have been only 36, for the three-year period. As of November [update]37 states and Washington, D.

Motor vehicle registrations in Australia are the responsibility of the state and territory governments. Two of these jurisdictions offer incentives or rebates for electric vehicles:. There are no electric vehicle incentives in New South WalesQueenslandSouth AustraliaWestern AustraliaTasmania or the Northern Territory. Electric and hybrid vehicles are exempt from customs duties since From Wikipedia, the free encyclopedia.

New energy vehicles in China. Renewable energy in China and Automobile industry in China. Plug-in electric vehicles in Japan.

The Inconvenient Truth About Electric Vehicles | utabumo.web.fc2.com

Plug-in electric vehicles in France. Plug-in electric vehicles in Germany. Plug-in electric vehicles in the Netherlands.

Plug-in electric vehicles in Norway. Plug-in electric vehicles in the UK. Plug-in electric vehicles in the United States. The Chevrolet Volt top and the Nissan Leaf bottom are PEVs eligible for a U. Government incentives for plug-in electric vehicles in California. California's green Clean Air Vehicle sticker for plug-in hybrids. California's white Clean Air Vehicle sticker for all-electric cars. See Acronyms and Key Terms, pp. Archived from the original on NEV production up percent".

Finnish Funding Agency for Innovation. Electric Vehicle Association of Asia Pacific. Japan Automobile Manufacturers Association. Archived from the original PDF on News from JAMA Asia. Japan Automobile Manufacturers Association Rebate for purchase or replacement with eco-friendly vehicles". Electric vehicles - European commission".

The New York Times. European Automobile Manufacturers Association. Opportunities for the Future" PDF. Consumer bonuses for electric and hybrid cars". Autonews France in French. A research agenda for studying the diffusion of innovative mobility concepts" PDF.

Click under "Overzicht stimuleringsprogrammas elektrische voertuigen Overview incentive programs electric vehicles to download the report in pdf format website in Dutch. These requirements must be met: Are there any tax relief or tax exemption benefits? The Green Car Website UK. September " [Electromobility Environmental bonus Interim balance of application as of 30 September ] PDF in German.

Department of the Environment, Community and Local Government. How To Get To The Tipping Point? Tassa Automobilistica" in Italian. RVO Dutch National Office for Enterprising. See under the headingsand for registrations figures for and through August See under the heading "" for total registrations figures at the end of December RVO Dutch National Enterprise Agency. See Financial stimulation, pp. Nissan Leaf costlier in Europe even with incentives".

Analyse over " [Special: Analysis of Closer look at the development of electric vehicles in ] PDF in Dutch. Norsk Elbilforening Norwegian Electric Vehicle Association. Verdens Gang in Norwegian. Norsk elbilforening Norwegian Electric Vehicle Association.

Aften Bladet in Norwegian. Electric cars in Norway make headway mixed with growing public debate". A energia que nos move.

deadspin-quote-carrot-aligned-w-bgr-2

Ministry of Environment, Water and Forests. Retrieved 13 September A total of 5, super clean cars have been registered in Sweden since Dagens Nyheter in Swedish. A total of 4, super clean cars and all-electric vans were registered in Sweden in In there were plug-in electric vehicles registered, in1, in and 4, super clean cars were registered during Since the introduction of the super clean car rebate in January until Decembera total of 7, super clean cars have been registered.

Government Offices of Sweden. As of 30 June [update]claims have been made through the plug-in van grant program. See graph with PIVG cumulative claims and claims by quarter. Click on "Ultra Low Emission Discount ULED " for details. Ontario Ministry of Transportation. See Table Box 7 for the rebate details and how it changes by year. See other figures in graphs.

New Qualified Plug-in Electric Drive Motor Vehicle Credit". Plug-In Hybrid Conversion Kits". Journal of the Transportation Research Board. Center for Sustainable Energy. Center for Sustainable Energy California. California Center for Sustainable Energy.

Jerry Brown signs bills to boost purchases of electric cars". California Clean Vehicle Rebate is increasing for low- and moderate-income drivers, and going away for high-income drivers on March 29". ACT Road Transport Authority. Retrieved from " https: Electric vehicle conversion Electric vehicles Plug-in hybrid vehicles Renewable energy policy Subsidies Taxation in the United Kingdom Taxation in the United States. CS1 French-language sources fr CS1 German-language sources de CS1 Icelandic-language sources is All articles with dead external links Articles with dead external links from April CS1 Italian-language sources it CS1 Dutch-language sources nl CS1 Norwegian-language sources no CS1 Portuguese-language sources pt CS1 Romanian-language sources ro CS1 Swedish-language sources sv Articles containing potentially dated statements from June All articles containing potentially dated statements Pages using citations with accessdate and no URL Wikipedia articles in need of updating from September All Wikipedia articles in need of updating Wikipedia articles in need of updating from January Articles containing potentially dated statements from Articles containing potentially dated statements from September Articles containing potentially dated statements from February Articles containing potentially dated statements from September Articles containing potentially dated statements from April Articles containing potentially dated statements from July Articles containing potentially dated statements from October Articles containing potentially dated statements from December Articles containing potentially dated statements from March Articles containing potentially dated statements from February Articles containing potentially dated statements from July Articles containing potentially dated statements from March Articles containing potentially dated statements from April Articles containing potentially dated statements from March Articles containing potentially dated statements from November Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 6 Juneat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. This section needs to be updated.

Please update this article to reflect recent events or newly available information.